Two Pot Retirement System

More than R730 million has already been paid out in over 38 000 two-pot claims. With an efficient processing and payment timeframe of just 5 to 10 working days, we provide timely support for members accessing their funds.

The Revenue Laws Amendment Bill of 2023 and the Pension Laws Amendment Bill were enacted by the President of South Africa, setting the stage for the implementation of the two-pot retirement system on 1 September 2024. Read the latest news update where we answer your questions on the two-pot retirement system here

WATCH TWO-POT VIDEO

Two pot series: Episode 1

Two pot series: Episode 2

How will the two-pot system work?

In summary, the two-pot system will operate as follows:

Vested component: All contributions and growth accumulated up to 31 August 2024 will be placed into the vested pot. Members' rights will be protected for the funds they have already contributed, and the vested pot will continue to operate under the rules that were in place before the 1 September 2024 amendments.

Savings component: Seed capital will become available on 1 September 2024 for members to withdraw. The savings in this pot can be accessed by the member once during a tax year, without having to terminate service. Members will be taxed at their marginal tax rates, on withdrawals made from the savings pot.

Retirement component: The retirement pot is designated for compulsory preservation and will only be paid to the member upon retirement. At retirement, the total value (if more than R165 000) in the retirement pot must be paid in the form of an annuity (monthly income).

When will I be allowed to access a portion of my retirement savings?

The implementation date for the two-pot system is set for 1 September 2024. You will be able to submit your application to withdraw the seed capital in your savings pot from this date. Thereafter, only one withdrawal from the savings pot can be made per tax year. The money will not be immediately available as the Fund will need to process the application, i.e., verification of banking details, calculation of tax payable, etc., before the money will be paid to you.

How much money will I be able to withdraw?

Seed capital (once-off) withdrawals: The seed capital amount will be taken from your vested pot (contributions plus investment returns earned up to 31 August 2024) and placed in your savings pot on 1 September 2024. The amount that will be made available for you to withdraw is 10% of your retirement savings as at 31 August 2024, limited to a maximum of R30,000. You will not be able to withdraw more than R30,000.

Annual withdrawals: You will be allowed to withdraw all or part (minimum of R2,000) of the amount accumulated in the savings pot once in each tax year.

NB! Tax and administration costs will be deducted from the withdrawal amount, and the balance paid into your bank account.

How much tax will I pay on withdrawals from the savings pot?

Any withdrawals made from the savings component will be taxed at your marginal tax rates if withdrawn before retirement. A withholding tax process will apply, and the withdrawal amount will be added to your annual income at the end of the tax year, potentially resulting in your tax bracket shifting to a higher bracket, which means you may end up with a higher tax amount to pay.

Will the two-pot system apply to all Fund members?

The two-pot system will not automatically apply to members who were 55 years and older on 1 March 2021. If you were 55 years and older on 1 March 2021 and want to be part of the two-pot system you have until 31 August 2025 to inform the Fund of your decision by opting in via the Sanlam MyPortfolio app and website sanlamonline.co.za The seed capital amount will be made available to withdraw on the first day of the following month. For the process to follow to opt-into the two-pot system click here. For members who are not able to opt-in via the Sanlam online platform or application, please complete and submit the following form to the Fund for processing.

How will I be able to make a withdrawal from the savings pot?

Members who are registered for Sanlam online access will be able to make easy automated withdrawals using their online access once the two-pot system has come into effect. Please note that your tax affairs must be in order, and the Fund must have your correct details on record, including contact details, ID-number, tax number, and correct surname (e.g., marriage/divorce), to process your withdrawal application.

Step by step guide on how to submit an emergency savings withdrawalWatch video on how to register and submit an automated savings withdrawal:

Watch Imali Zam Q&A sessions:

Watch the Imali Zam Q&A session in English

Watch videoWatch the Imali Zam Q&A session in Xhosa

Watch videoWatch the Imali Zam Q&A session in Setswana

Watch videoTherefore, all members are urged to register for online access to avoid unnecessary delays and ensure timeous processing of the withdrawal applications.

IMPORTANT NOTICE: The Sanlam MyRetirement application has been replaced with the NEW Sanlam MyPortfolio application to accommodate the new two-pot system. Please uninstall the old MyRetirement app and download and install the new Sanlam Portfolio App from Google Play and Apple App store. The login process remains unchanged.

- Scan the QR code or

- Download the free Sanlam My Portfolio App or

- Click here to register

The Fund must have your updated contact information on record for OTP-verification as part of the registration process. Need to update your contact information? Please contact the SC Client Care on: SCClientCare@sanlam.co.za or send a WhatsApp or call on: 0861 223 646 to update your contact information, they will also be able to assist with registration for web access enquiries.

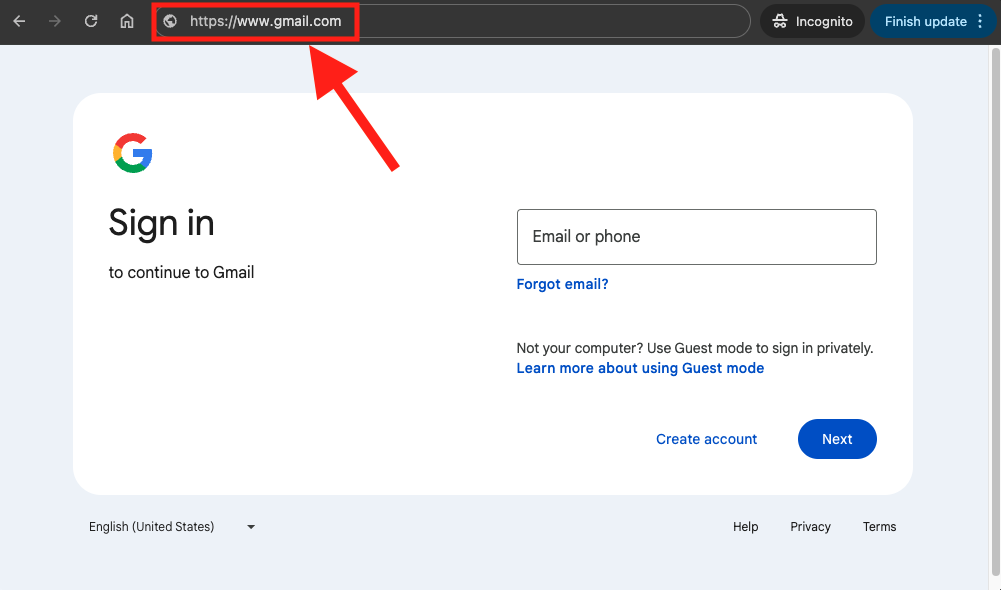

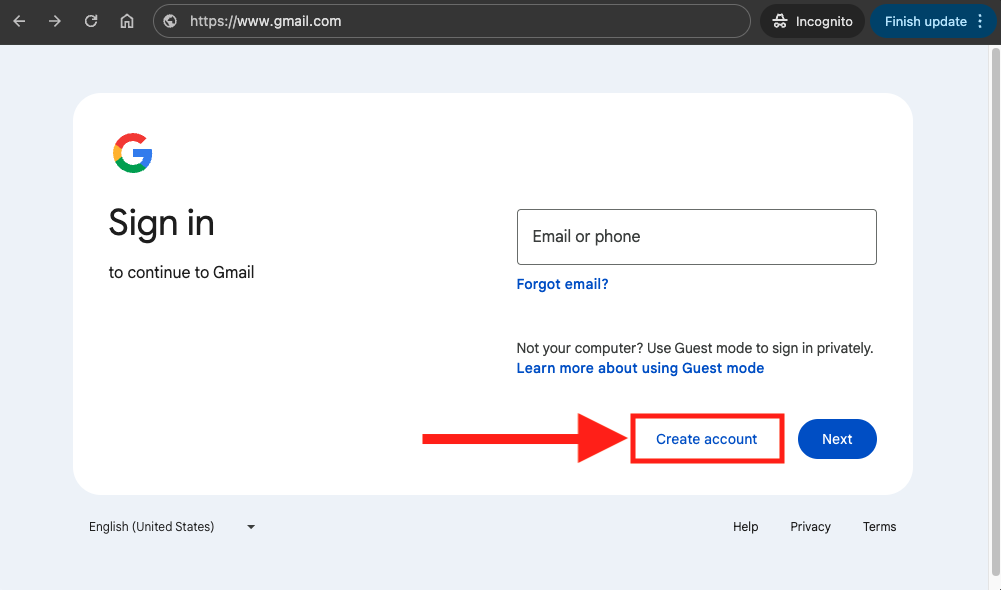

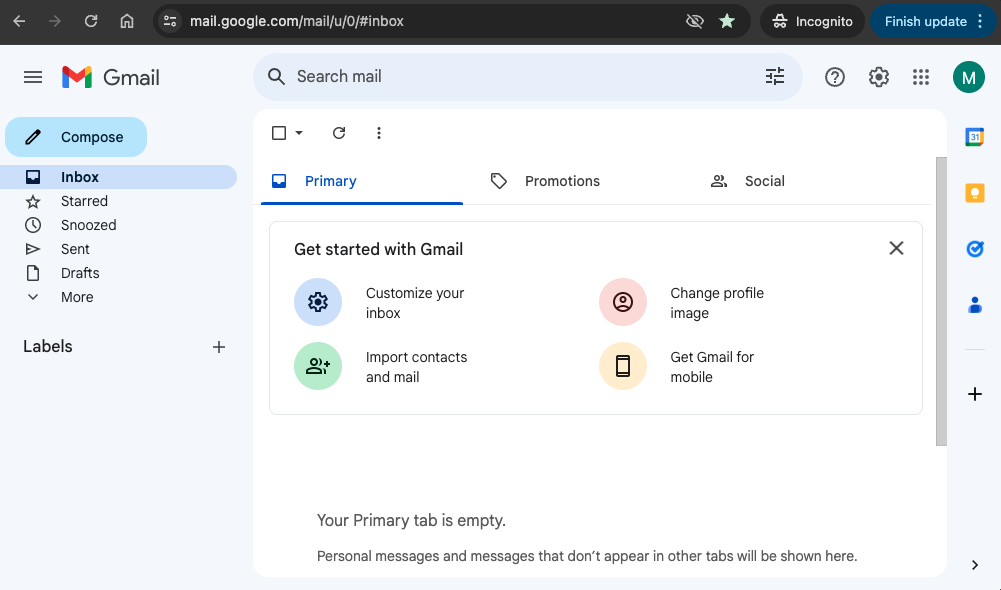

How to Create a Gmail Account

How to Create a Gmail Account

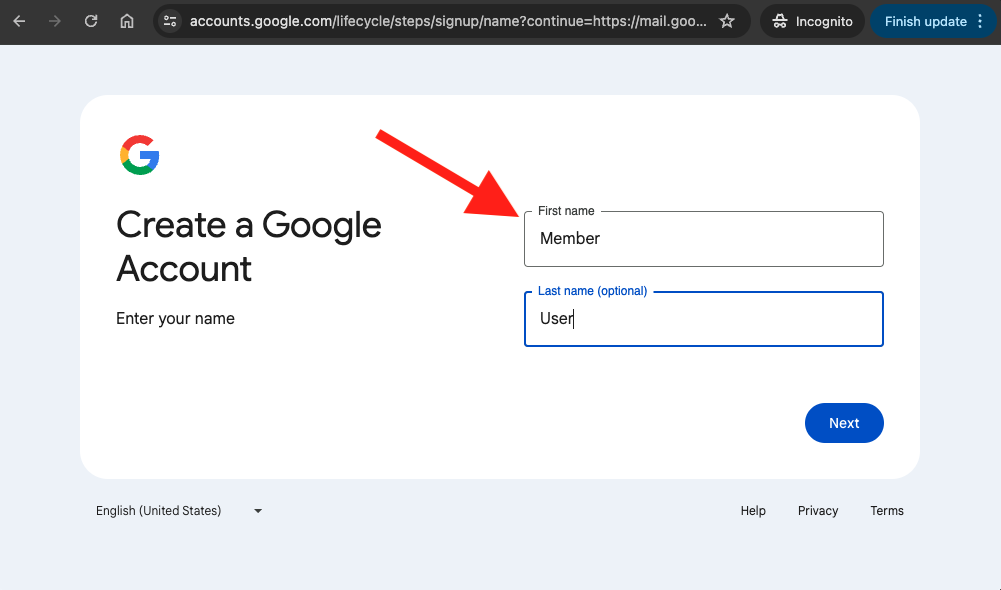

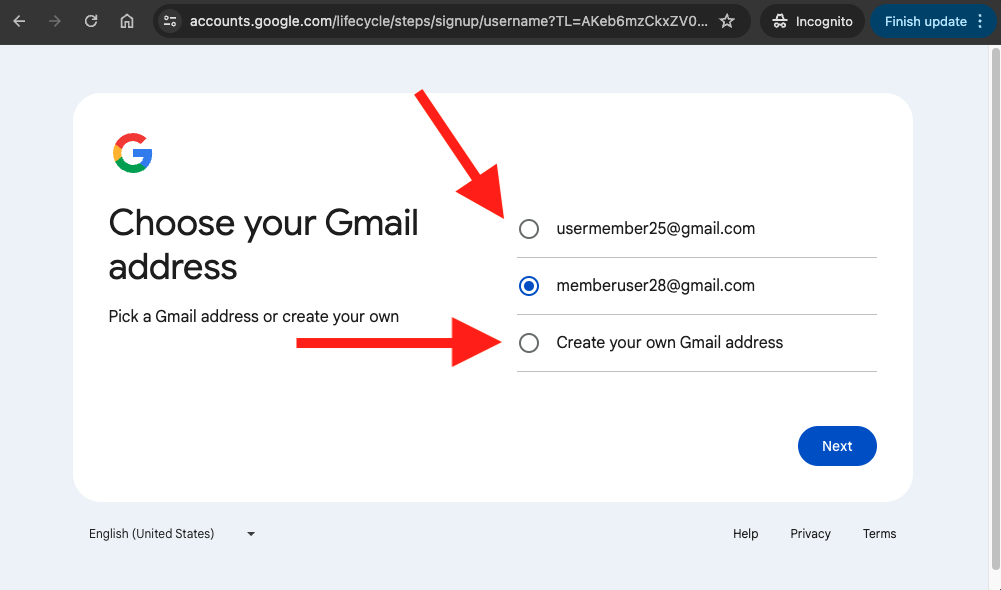

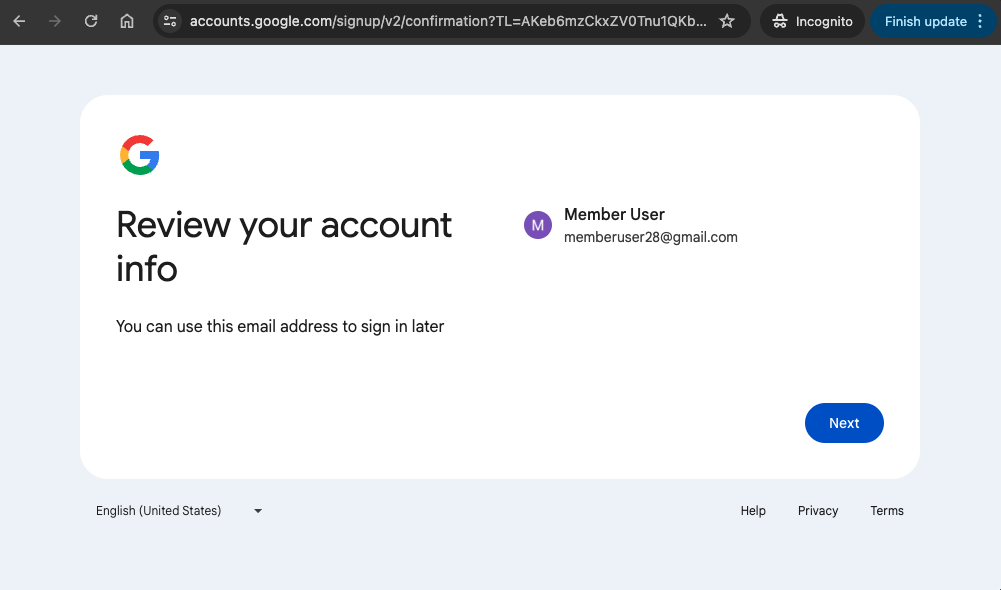

Step 3: Create a Google Account

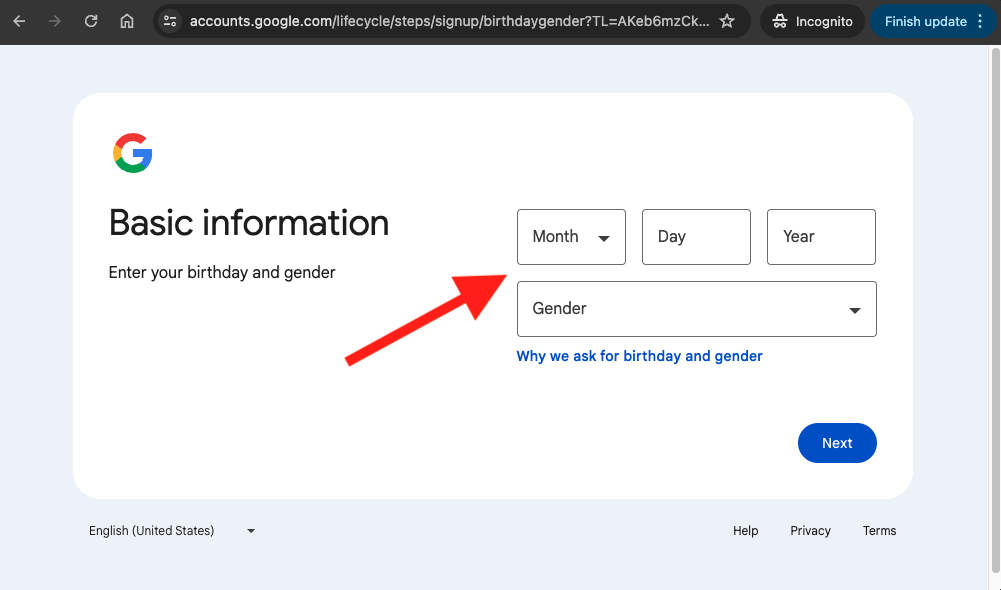

Enter your first and last name (Last name is optional) and click next.

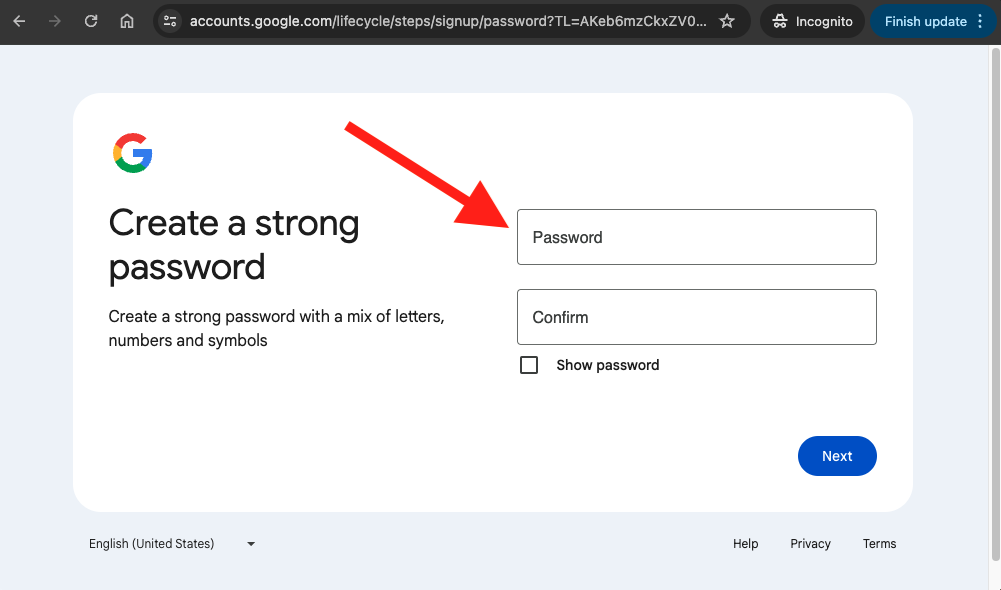

Step 6: Create a strong password

Create a strong password with a mix of letters, numbers and symbols and click next.

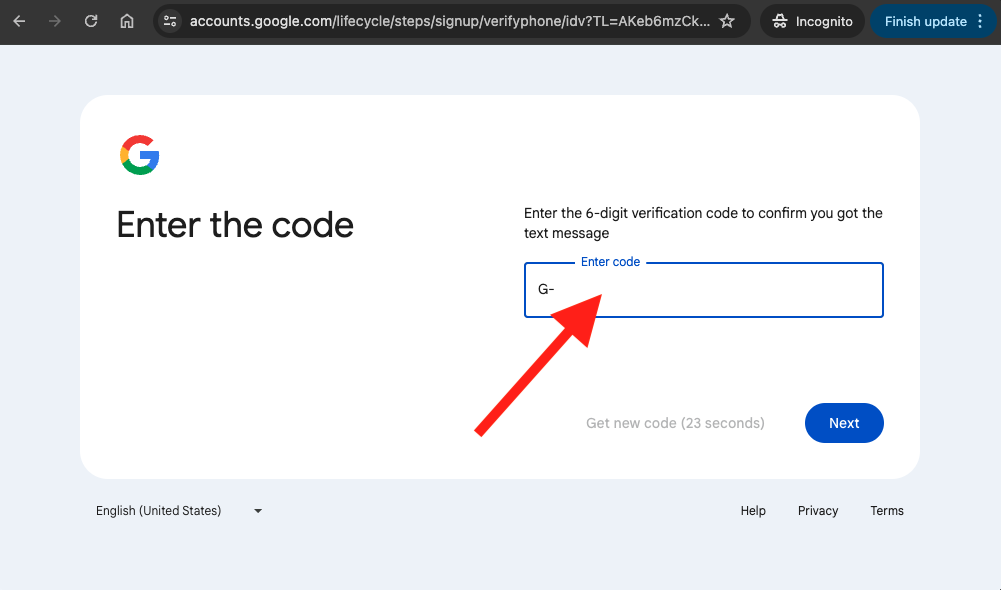

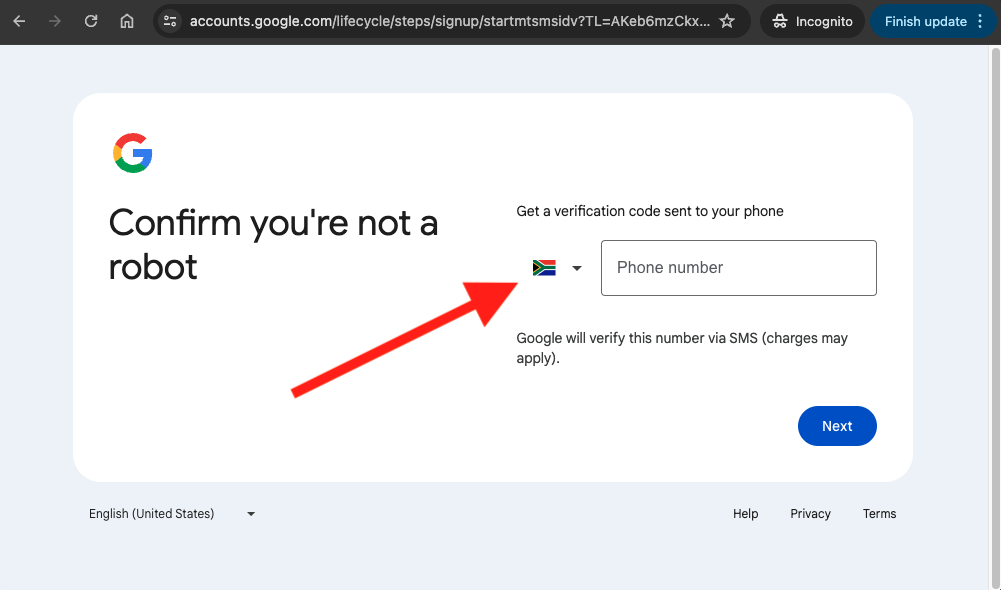

Step 8: Enter the code

Enter the 6-digit verification code sent to your phone to confirm you got the text message.

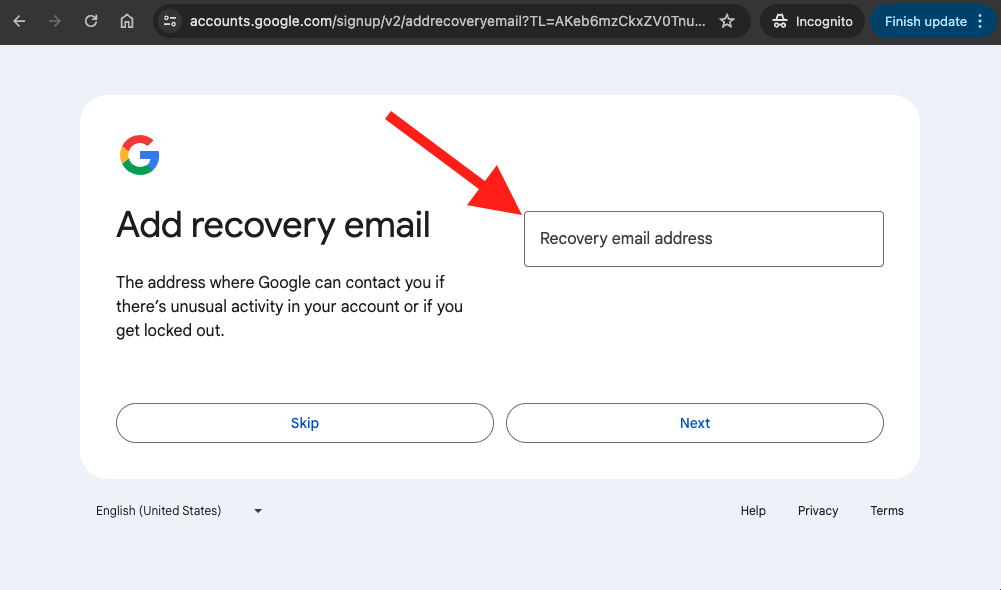

Step 9: Add recovery email (Optional)

The address where Google can contact you if there’s unusual activity in your account or if you get locked out.

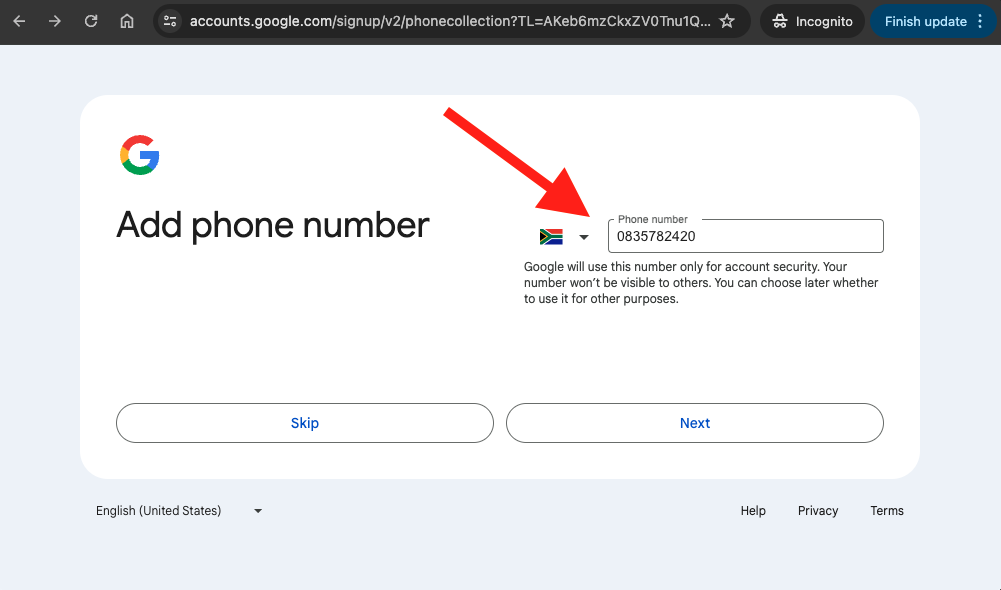

Step 10: Add phone number (Optional)

Google will use this number only for account security. Your number won’t be visible to others. You can choose later whether to use it for other purposes.

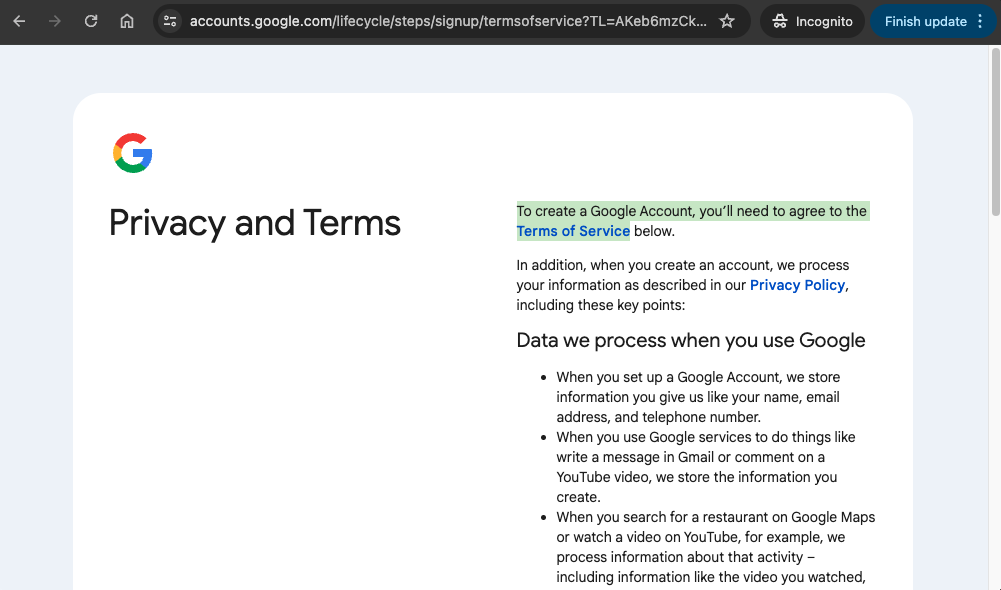

Step 12: Privacy and Terms

To complete creating a Google Account, you’ll need to agree to the Terms of Service.

Cookie Notice

Cookie Notice Cookie settings

Cookie settings