The NFMW received a clean audit for the 2021/2022 financial year, confirming that the Fund’s financial statements are free from material misstatements and there are no material findings on reported performance objectives or non-compliance with legislation. These financial statements were submitted to the Financial Sector Conduct Authority within the required time frame (six months from the end of the financial year).

We are proud of this achievement as it is testament to the Fund’s commitment to ensuring good governance, financial compliance, and effective internal controls.

Latest Economic Update

The year that was…

2022 was a year full of separate events which had significant economic impact. These events combined into a perfect storm in many ways, as it almost felt that everything that could go wrong, did go wrong.

The year started out with a global inflation problem post Covid, but then the Russian-Ukraine war compounded this into a full-blown crisis, as energy and food prices soared. The resultant reaction from central banks was to aggressively raise interest rates and reduce liquidity (money supply) within their economies to try and bring inflation under control.

As a result, financial conditions, business and consumer sentiment as well as slower economic growth resulted in sharp market downturns. Global equity and bond markets turned negative and left investors with no place to hide as asset prices in general took a tumble. Equity markets did, however, recover somewhat during November 2022, and continued on this path for the year to date, which brought a “feel-good factor” into the new year. Unfortunately, most of the issues mentioned above remain unresolved going into 2023, which means that investors will still face a complex political and economic environment.

Globally, inflation and interest rates still remain high

As mentioned, inflation was already a known global challenge at the start of 2022 and South Africa was not spared this fate. This was mainly as a result of many supply and demand shocks emanating from the Covid pandemic, and the uncoordinated re-opening of world trade and activity.

US inflation peaked midway through 2022 and was running at 9.1% whilst Europe experienced double-digit inflation (>10%) for the first time ever. In South Africa, our inflation almost crept up to almost 8%, which caused our central bank to follow suit and significantly raise interest rates.

As one can imagine, this action created difficult financial conditions for businesses and consumers alike, as higher debt repayments and increased prices of goods and services reduced their spending power. The global interest hiking cycle is still underway in many countries and will probably only slow down or cease towards the latter part of 2023.

Geopolitical tensions and the covid aftermath remain

The conflict in Europe had a profound impact on commodity, energy, and food prices which reinforced the inflation problem globally, but hit Europe particularly hard. The fall-out from the war is wide and will affect many economic and political relationships for many years to come. Some of the challenges that will remain include oil and gas supplies, coordinated sanctions against Russia and political repercussions. These issues are complex and will remain ongoing for the foreseeable future.

This brings us to China which persisted with a zero-Covid policy throughout 2022, which heavily impacted economic growth out of this region. However, as restrictions are lifted, solid economic growth should return together with a spike in economic activity. Demand for goods and services may fuel commodity prices and possibly add to the already high global inflation. Chinese and US relations remain strained and the concerns of integrating Taiwan into China are bigger than ever, leaving investors with an uncertain outcome.

South Africa weathered the global storm, but growth is constrained

South Africa by and large escaped a major inflation shock, as wage inflation remained under control. The government’s revenue collection remained well ahead of budget as commodity prices held on to their recent highs. Headline CPI did, however, spike to 7.9% in July, mainly as a result of fuel and food inflation. This subsided towards the end of the year, and expectations are that the lower inflation trend will continue well into 2023. However, the recently announced 18.65% electricity price increase is expected to add 0.5% to the 2023 inflation figure!

The South African Reserve Bank’s (SARB) preferred inflation target remains at 4.5%, but it will take some time for it to return to those levels. During 2022, the Monetary Policy Committee raised interest rates (the repo rate) by a cumulative 3.5%, doubling the nominal rate from its low point of 3.5% to 7%. This has a profound impact on the spending power of consumers which will impact SA’s growth going forward.

Unfortunately, the reduced availability and reliability of electricity from Eskom, resulted in loadshedding for more than 200 days during 2022 – the most severe in history. It is estimated that GDP growth will be more than 1% lower as a result. The end thereof is not yet in sight, and the negative impact will continue until a viable solution can be found and implemented.

SA’s economic challenges can only be addressed if the economy can generate sufficient growth to alleviate unemployment, together with poverty and inequality.

Looking forward into 2023

The rise in inflation and interest rates has painfully raised the cost of living for much of the world over the last few years, resulting in lower consumer confidence and economic activity. However, the outlook for 2023 seems to be more positive compared to 2022, even though most of the issues mentioned above remain unresolved going into 2023.

The first half of 2023 will remain challenging, as many countries still face possible economic recessions and businesses across the globe are facing a slowdown in earnings. Central banks will not rest until inflation is well and truly under control, and this will still impact economic activity, resulting in slow growth together with relatively high inflation. Towards the end of the year, we will hopefully see inflation subside, interest rates peak and geopolitical tension ease. Whilst clear-cut outcomes to the issues remain unresolved, investors should expect more volatility and, possibly, some negative outcomes.

In South Africa, the domestic energy crisis may prompt more definitive action, leading to private power generation and provision. This may well create a positive feedback loop for additional investment spending. In summary, SA’s economic outlook is much dependent on the political situation, public and private sector participation, energy availability, implementation of economic policy, and infrastructure upliftment – ultimately leading to more job opportunities and higher productivity.

Latest market returns and more detailed commentary

Global equity markets ended the year on an uncertain note, giving back half of November’s gains as recession fears coupled with a surge in Covid cases in China put investors on edge.

While the US inflation trend appears downward, the Federal Reserve has reiterated that an important component in determining the path of future interest rates, will likely be determined by services and wage inflation. The Federal Reserve, however, raised interest rates by 0.5% in December and officials have indicated interest rates will remain high throughout 2023.

Meanwhile, China’s relaxation of Covid controls has led to a surge in Covid infections which could impact productivity and result in further supply chain disruptions, but Chinese stocks turned positive after a difficult year. Global bonds gained 0.5% in the month as yields declined in the month on recession fears. The annual return of -16.3% for global bonds is the worst ever recorded, as global central banks hiked interest rates at the fastest pace ever to combat runaway inflation.

In South Africa, inflation slowed to 7.2% in December 2022. A sharp drop in fuel prices in January 2023 should provide some relief to consumers who appear to be relying much on credit to get through the first month after the festive season. On a positive note, the demand side of the economy was lifted by a rise in exports and government consumption. The size of the economy now exceeds pre-pandemic levels.

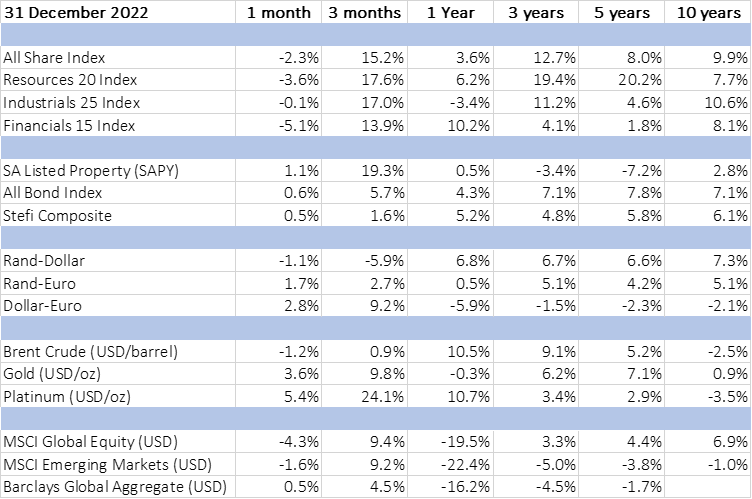

The All Share Index returned +15.2% for the quarter and +3.6% for the year as the rand strengthened by 1% against the dollar to settle at R17 at year end (but depreciated by 6.8% for the year). Please refer to the table below for a more comprehensive set of returns over various periods and markets:

Stay focused on long-term investment objectives

As stated before, we do not know when economic conditions will become more certain for investors (and members), but we do feel that many of 2022’s unresolved issues (high inflation and interest rates, Russian-Ukraine war and the Covid aftermath) should conclude within the next 6 – 18 months. However, this leaves members with multiple potential outcomes in terms of returns over the very short term. The NFMW portfolios remain well diversified and structured to offer members valuable protection under volatile conditions, but also have enough potential to participate in up-trending markets.

We fully understand that in times like these, volatility and performance can be worrisome for members, but we would like to remind members that it remains of utmost importance to focus on longer-term return prospects and investment strategies and objectives, as short-term volatility and any reaction thereto could easily result in incorrect investment decisions. We would like to remind members that the highest likelihood of achieving one’s investment objective and goals is still to remain invested over time and participate in upward trending markets.

Regards,

Mr Leslie Ndawana

Principal Executive Officer.

Cookie Notice

Cookie Notice Cookie settings

Cookie settings