Cover in the Case of Death and Disability

At the NFMW, our main purpose is to secure our members’ financial futures, but we also understand the importance of making sure that our members’ families are taken care of in the case of the members’ death and that members have the peace of mind that they will not be left destitute, should they become disabled.

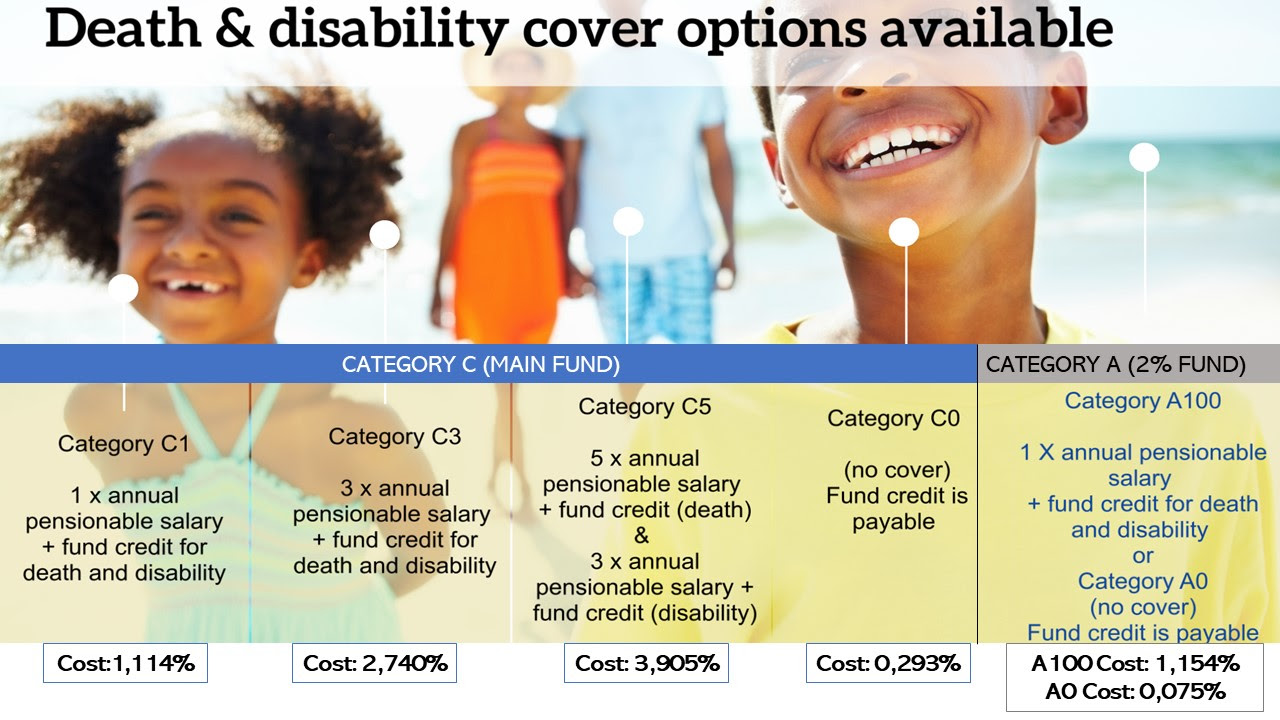

As part of the NFMW’s superior benefit offering, we provide members with the option of having death and disability cover within the Fund, giving them the peace of mind that their families will be taken care of in case of the unforeseen happening. Members can elect from any of the following risk cover options available:

The cost of the cover is deducted from the employer contributions. Members can also choose the no-cover option, in which case they save more towards retirement, but only the fund credit is payable, should the member pass away or become disabled. The following example shows the difference in a death and disability benefit payable where a member elected Category C3 compared to a member with no cover. This is based on an annual salary of R300 000 and a fund credit of R100 000.

| NFMW Member who elected C3 | C0/No cover elected | ||

|---|---|---|---|

| 3 x R300 000 (annual salary) + R100 000 (fund credit) = R1 000 000 000 payable should the member die or become disabled. |

R100 000 fund credit is payable should the member die or become disabled |

Funeral benefits for you and your qualifying family members

The NFMW also provides ALL our members and their qualifying family members with a funeral benefit, to assist in covering the cost of laying a loved one to rest. This benefit is payable within 48 hours after the required documents have been submitted to the Fund and includes a repatriation benefit that offers the service of transporting the deceased to place of burial.

| CATEGORY C (MAIN FUND) | CATEGORY A (2% FUND) | |

|---|---|---|

| Main member | R 48 500 | R11 500 |

| *Qualifying spouse/life partner | R 48 500 | R11 500 |

| Qualifying child 6 years and older (21 years of age to age 26 must be a full-time student, unmarried and/or disabled) | R 24 250 | R4 700 |

| Qualifying child from 26 weeks of pregnancy until 6 years | R 11 000 | R4 700 |

*Members must ensure that their life partners are registered with the fund, by completing and submitting the Application for Registration of a Life Partner-form in order to qualify for the funeral benefit.

DID YOU KNOW? If a member dies or become disabled whilst in service, the qualifying family members will remain covered for the funeral benefit until the member would have attained the age of 65.

Voluntary funeral cover and burial packages for extended family

We know that our members may also have other family members who are dependent on them and who they are responsible for. NFMW-members can opt to make use of any of the voluntary funeral benefits available, which include funeral cover for their extended family members and burial packages structured to best suit their individual needs.

- Burial packages (Kgatso Funerals 087 160 0568)

- Funeral cover for parents, parents-in-law and up to eight extended family members and

- Funeral cover conversion option which allows members to continue with their funeral cover when they resign, are retrenched or retire (Sanlam 0860 222 556)

The number of people the member wishes to insure and the amount of cover/package they choose will determine the monthly premium payable. The premium is payable directly to the provider by monthly debit order.

THESE BENEFITS FORM PART OF THE NFMW’S SUPERIOR BENEFIT OFFERINGS AND ARE IN LINE WITH THE FUND’S VISION OF POSITIVELY IMPACTING THE LIVES OUR MEMBERS, THEIR FAMILIES AND COMMUNITIES TODAY AND TOMMOROW.

Mr Leslie Ndawana

Principal Executive Officer.

Cookie Notice

Cookie Notice Cookie settings

Cookie settings