NFMW Default life stage model: New approach to portfolio switching effective from 1 March 2021

The fund is implementing a “phasing-in” approach for default portfolio switches effective from 1 March 2021

The NFMW applies a life stage model which automatically takes members through different investment portfolios i.e. aggressive to more conservative portfolios as they near retirement age. The Board of Trustees of the National Fund for Municipal Workers recently assessed and reviewed the fund’s current default life stage model and the process of switching a member’s fund value to a lower risk portfolio as they get closer to retirement.

How is the default switch currently implemented?

Currently, for members who do not feel confident in selecting the portfolio that would best suit their risk profile and circumstances, fund values (and contributions) will automatically be invested in a default life stage strategy. The default life stage investment portfolio varies with age according to the following schedule:

Aged younger than 55: Aggressive Growth portfolio

Aged between 55 and 62: Capital Growth portfolio

Aged 62 and older: Stable Growth portfolio

Once a member has reached the recommended age limit for a portfolio, the member’s total fund value is switched to the new recommended lower risk portfolio and all future contributions will be allocated to the same lower risk portfolio. This all happens at the end of the member’s birthday month i.e. when reaching the stated age as indicated above.

What will change going forward and why?

The Board of Trustees decided to implement a “phasing-in” approach when switching a member’s fund value to a lower risk portfolio. It means that not 100% of a member’s fund value will immediately be switched to a lower risk portfolio when reaching the stated age as indicated above.

The reason for this decision is to protect members’ fund values against volatile or severe market movements which sometimes occur over short periods of time. Switching 100% of a member’s fund value at a specific point in time to a different portfolio, may in some instances be to the detriment of that member.

The process will mostly stay the same i.e. for members who do not feel confident in selecting the portfolio that would best suit their risk profile and circumstances, fund values will still automatically be invested in the same default life stage strategy, with the same age bands as indicated above.

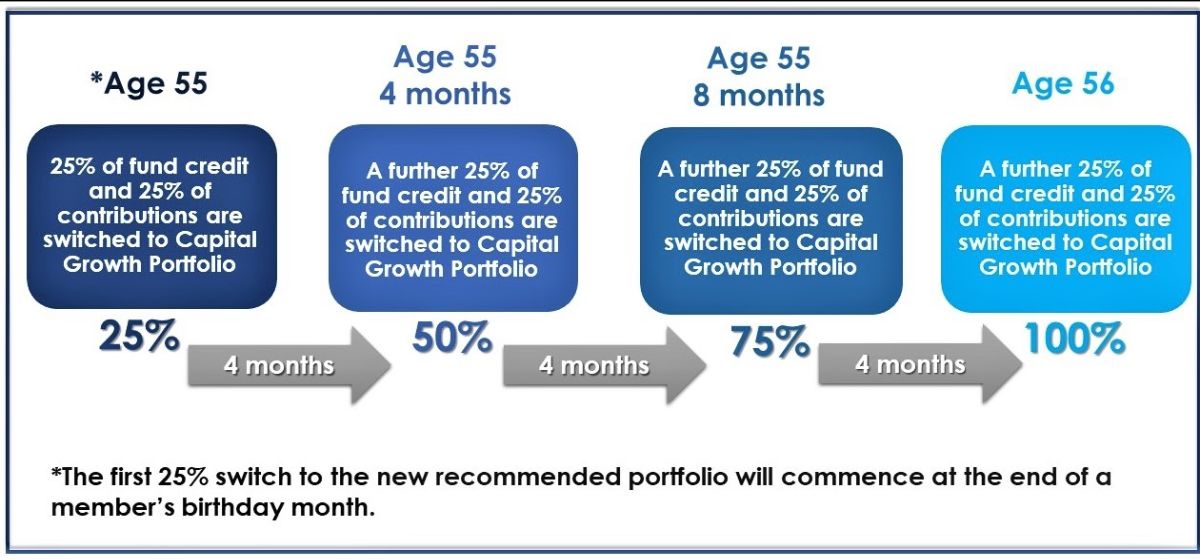

However, once a member has reached the recommended age limit for a portfolio, 25% of the member’s assets (fund credit) and 25% of subsequent contributions will immediately be switched to the lower risk portfolio. A further 25% of assets and subsequent contributions will be switched after every four months until 100% of the fund credit and subsequent contributions have been switched to the lower risk portfolio i.e. after a 12 month period.

The first 25% switch to the new recommended portfolio will commence at the end of a member’s birthday month. As a result, it will take 12 months for a total portfolio switch to be completed. After the 12 month phase-in period, all future member contributions will automatically accrue to the new default life stage portfolio. See an illustration of a default switch from the Aggressive Growth portfolio to the Capital Growth portfolio below.

THE PHASING-IN APPROACH WILL ONLY APPLY TO DEFAULT LIFE STAGE PORTFOLIO SWITCHES AND NOT TO INDIVIDUAL MEMBER CHOICE SWITCHES.

When will these changes be implemented and do I have to do anything?

The changes to the default life staging will be implemented effective from 1 March 2021. No action is required from you and the fund’s administrator (Sanlam), will ensure that the changes described above are implemented.

It needs to be emphasised that the default life stage model remains intact and the portfolios currently on offer, remain the same. Only the process to de-risk to a lower risk portfolio has been amended to benefit members over the long term.

Cookie Notice

Cookie Notice Cookie settings

Cookie settings