Finance Minister Enoch Godongwana delivered the 2023 Budget Speech where he announced various retirement fund industry-related changes and developments which include:

- Revised retirement and withdrawal tax tables

- Retirement reform – “two pot system.”

- Transfers between retirement funds

- Deductible employer contribution to retirement funds

Let us look at these in more detail.

REVISED RETIREMENT AND WITHDRAWAL TAX TABLES

Slightly higher tax-free portion on lump-sum payments

The rates of tax payable on retirement fund lump-sum benefits have been adjusted and are proposed to be effective as from 1 March 2023. All the benefits will be adjusted upwards by 10% to compensate for inflation and will provide for a slightly higher tax-free portion on retirement and resignation lump-sum benefit payments.

Tax payable at retirement

Members who retire (i.e., end service aged 55 years and older) will pay the following rate of tax on lump-sum payments.

| Taxable income from lump-sum benefits (R) | Rate of tax (R) |

|---|---|

| 0 – 550 000 | 0% of taxable income |

| 550 001 – 770 000 | 18% of taxable income above 550 000 |

| 770 001 – 1 155 000 | 39 600 + 27% of taxable income above 770 000 |

| 1 155 001 and above | 143 550 + 36% of taxable income above 1 155 000 |

This tax table is also applicable to severance/retrenchment and death benefit payments.

Tax payable on resignation

Members who end service before the age of 55 will be taxed according to the following tax table on all lumpsum payments.

| Taxable income from lump-sum benefits (R) | Rate of tax (R) |

|---|---|

| 0 – 27 500 | 0% of taxable income |

| 27 501 – 726 000 | 18% of taxable income above 27 500 |

| 726 001 – 1 089 000 | 125 730 + 27% of taxable income above 726 000 |

| 1 089 001 and above | 223 740 + 36% of taxable income above 1 089 000 |

RETIREMENT REFORM - "TWO-POT SYSTEM"

ADDITIONAL WORK REQUIRED

The Fund has communicated extensively on the proposed two-pot system, which will allow early access to retirement savings and encourage compulsory preservation.

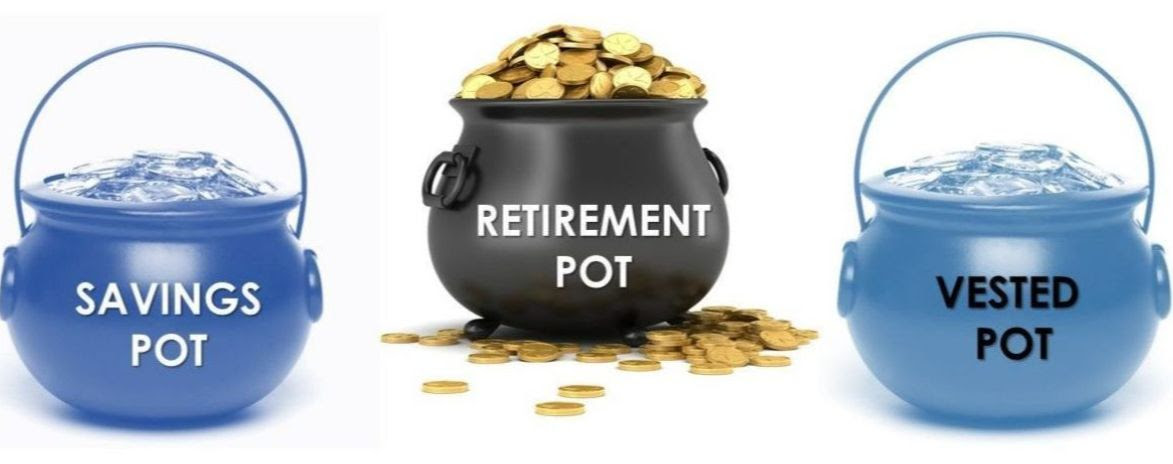

To summarise, the proposed “two-pot” system makes provision for a vested pot that will house the member’s accumulated savings (up to the point that the new legislation comes into effect), a savings pot that members can access once a year (these withdrawals will be taxed at the member’s marginal tax rate as per their annual income), and a retirement pot that can only be accessed by the member at retirement. Savings in the retirement and savings pots will only start to accumulate with contributions (up to one-third and two-thirds split) and growth thereon from the date of implementation of the new legislation. Click here for the full article NFMW Latest news update | National Fund for Municipal Workers

Following public consultation, the first phase of legislative amendments to the retirement system is due to take effect on 1 March 2024. The minister, however, indicated that the two-pot system still required the following additional work:

- A proposal for seed capital – this is a proposal to allow immediate access of a certain portion of the members’ savings in their retirement fund on the effective date.

- Legislative mechanisms to include defined benefit funds in an equitable manner.

- Proposals to deal with the “legacy provisions” of certain retirement annuity funds (i.e. where the products which underpinned such funds did not contemplate such early access prior to retirement or death of the member); and

- Withdrawals from the retirement portion if a member is retrenched and has no alternative source of income.

The first three areas will be clarified in draft legislation that is still to be released and no indication has been given on when this will be issued. The fourth area will be reviewed at the second phase of implementation. We will as always, keep you informed of any new developments.

TRANSFERS BETWEEN RETIREMENT FUNDS

Applicable to members who are older than normal retirement age

The current tax dispensation applicable to transfers between retirement funds by members who are older than normal retirement age, allows for the following tax-free transfers:

- Pension/provident fund transfers to preservation/retirement annuity funds.

- Preservation fund transfers to preservation/retirement annuity funds.

However, the following transfers are not treated as tax-free:

- Retirement annuity fund transfers to retirement annuity funds in respect of members over the age of 55.

- Transfers of members’ benefits from pension/provident funds to pension/provident funds where the member is older than the normal retirement age (as determined by their employer).

Government is proposing that pension/provident transfers to pension/provident funds be tax free for involuntary transfers (i.e., transfers initiated by the participating employer of the fund or the board of the fund). The amount transferred and any growth thereon will remain ringfenced and preserved in the receiving pension/provident fund until the member elects to retire from that fund. The Budget documentation does not indicate transfers between retirement annuity funds to be tax free.

DEDUCTIBLE EMPLOYER CONTRIBUTION TO RETIREMENT FUNDS

Clarifying the tax-deductible amount of employer contributions to retirement funds

The Income Tax Act considers an employer contribution to a retirement fund as a contribution made by the employee, and it is calculated as the amount equal to the cash equivalent of the value of the taxable benefit. There is however no requirement that the calculated cash equivalent be included in the employee’s income.

It is proposed that the Act be amended to require that the cash equivalent of the taxable benefit for employer retirement fund contributions be included in an employee’s income before a tax deduction is allowed.

Cookie Notice

Cookie Notice Cookie settings

Cookie settings